- Sponsored Content

“Was there anything in the Australian Budget this year which expats should be aware of?”

The Australian Budget was handed down on 11 May 2021 by the Federal Treasurer Josh Frydenberg and could be considered by some as an Election Budget. There was plenty of spending, with a deficit of $106.6 bn, bringing our National debt to $729 bn (which is 34.2% of GDP), and included resident personal and business income tax cuts, offsets, and housing benefits. However, for expats, the budget papers needed to be looked at a little closer and below are the top tips to take note of:

PROPOSED AUSTRALIAN TAX RESIDENCY CHANGES

This is probably the most impactful change for Australian expats and further details on these have been covered in a separate feature at anza.org.sg. The likely date of the change is 1 July 2022, however pending Royal Accent, these could be introduced from 1 July 2021 and will impact expats who are in Australia for more than 44 days in a financial year.

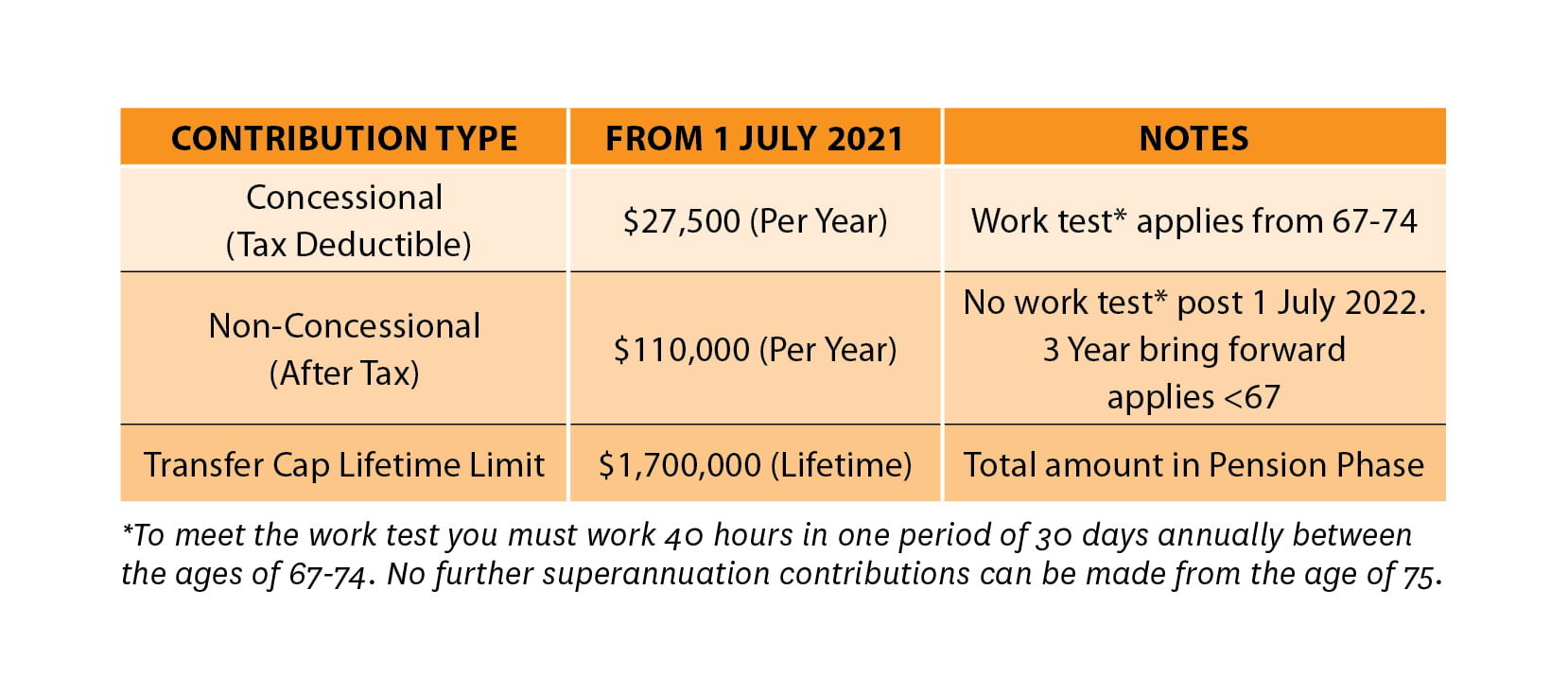

- Superannuation Annual Limits

Even as an expat, you can continue to contribute to superannuation, however this is a taxable locked up environment, when for most expats in Singapore, personal investments are Income Tax and Capital Gains Tax free. See table: - Superannuation downsizer contributions reduced to age 60

For those expats who are looking to sell their former main residence (PPR) when they return to Australia and boost their super close to retirement (note you need to sell as a tax resident to now qualify for the PPR Exemption, and you must have owned it for 10 or more years), you have the ability from age 60 to do so and contribute up to $300,000 (each if you are a couple) into super from the house proceeds. Some planning is needed for this option to ensure you meet the criteria so please seek advice before acting. - Self-Managed Superannuation Funds (SMSF)

From 1 July 2021 progressively, SMSF’s will be more flexible for expats to hold while living offshore. Currently these basically must be put on ice due to strict Australian residency and control requirements. However, changes will extend the need to have central management and control in Australia from 2 to 5 years and allow members to be able to continue to contribute to their funds while they are an expat. Currently expats must contribute into a separate commercial fund and only roll this amount back into their SMSF when they get back to Australia.

Contact details for consultation

Contact details for consultation

It is important to note that the above is only general advice and everyone’s situation is different. Accordingly, please contact tristan.perry@selectinvestorsaustralia.sg or

+65 9108 6398 (phone or WhatsApp) for an obligation free appointment to discuss your specific circumstances.

The levels and bases of taxation, and relief from taxation, can change at any time. The value of any tax relief depends on individual circumstances.