- Sponsored Content

When it comes to investment rates, to say things are on the up is an understatement. The last time the Reserve Bank of Australia (RBA) increased rates was back in November 2010. On 7 June 2022, the RBA increased the cash rate by 0.50% bringing the official cash rate to 0.85%. It was an unexpected move by most forecasters in the market and unwelcome news for mortgage holders.

How high will rates go?

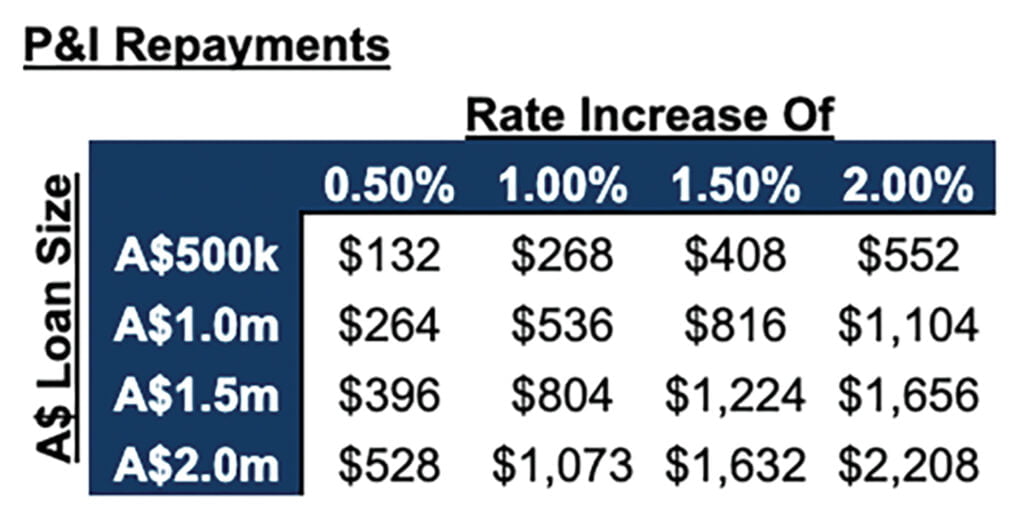

It’s not great news. The RBA has signaled further rate increases are on the horizon. Right now, it’s not unreasonable to expect the cash rate to increase to 2.5% over the next 24 months – this means a further cash rate increase of 1.65%. The RBA has an inflation rate target of between 2-3% and they will continually increase the cash rate until this target is achieved. Taking this into account, the forecast for inflation in 2022 is 6%. By mid-2024, headline and underlying inflation are forecast to have moderated to around 3%. These forecasts assume further increases in interest rates. Chances are, if you have a mortgage in Australia, you’ll likely feel the impact the most. For a clearer understanding of how things are going, see the table below for estimated changes in monthly loan repayments for different levels of increases:

What can you do?

Now is a good time to do some budgeting exercises. Consider fixing your mortgage interest rate before it’s too late. Talk to your bank or broker to see what the best interest rates are on offer, then compare against your own and switch it if it’s in your best financial interests. Investment property home loan rates are currently around 4 – 5 % for Australian expats and there are many banks offering cash incentives to refinance.

Will the rate hikes lower Australian property prices?

When interest rates are rising in Australia, property prices are generally trending in the opposite direction. However, that doesn’t mean you should jump for joy at the thought of buying a cut-price property. The correlation between Australian property prices and interest rates comes down to familiar supply and demand dynamics. Higher interest rates mean buying a property is more expensive, weakening demand, and making prices plateau and drop. The RBA will use higher interest rates to combat rising inflation – which is how they justified the most recent increase – but many will continue to feel a tightening in living standards.

That said, the RBA is pitching this rise as a “normalising” of interest rates and predicts it could rise as high as 2.5%, which could lead to a drop of 15% in property prices. Powering this is the RBA’s prediction of a 4% increase in GDP this year, although a worse than predicted economic performance could see interest rates held and the housing market become stagnant while both buyers and sellers wait to see which way things move.

Does this mean good news for buyers?

Not necessarily. Property prices in the most desirable locations will likely continue to increase or, at least, won’t drop off as much as they will elsewhere. This would mirror trends seen globally, including in the UK, where they face a full-blown cost of living crisis.

Anyone planning a purchase in Australia shouldn’t wait to do it. Waiting for the market to move or making economic predictions is a fool’s errand, so taking action now is likely to be far more fruitful than trying to be too clever.

Contact the team at Odin Mortgage today to see how they can help you to achieve your dream sooner. odinmortgage.com

Contact the team at Odin Mortgage today to see how they can help you to achieve your dream sooner. odinmortgage.com