- Sponsored Content

If you’re considering changing your financial adviser in 2023 or taking your first steps in the world of expat financial advice, it’s important to make sure you’re asking the right questions.

If you’re considering changing your financial adviser in 2023 or taking your first steps in the world of expat financial advice, it’s important to make sure you’re asking the right questions.

The financial advice industry here continues to expand and combining this with a trusted regulator means Singapore offers a much safer environment for investors than other areas of South-East Asia.

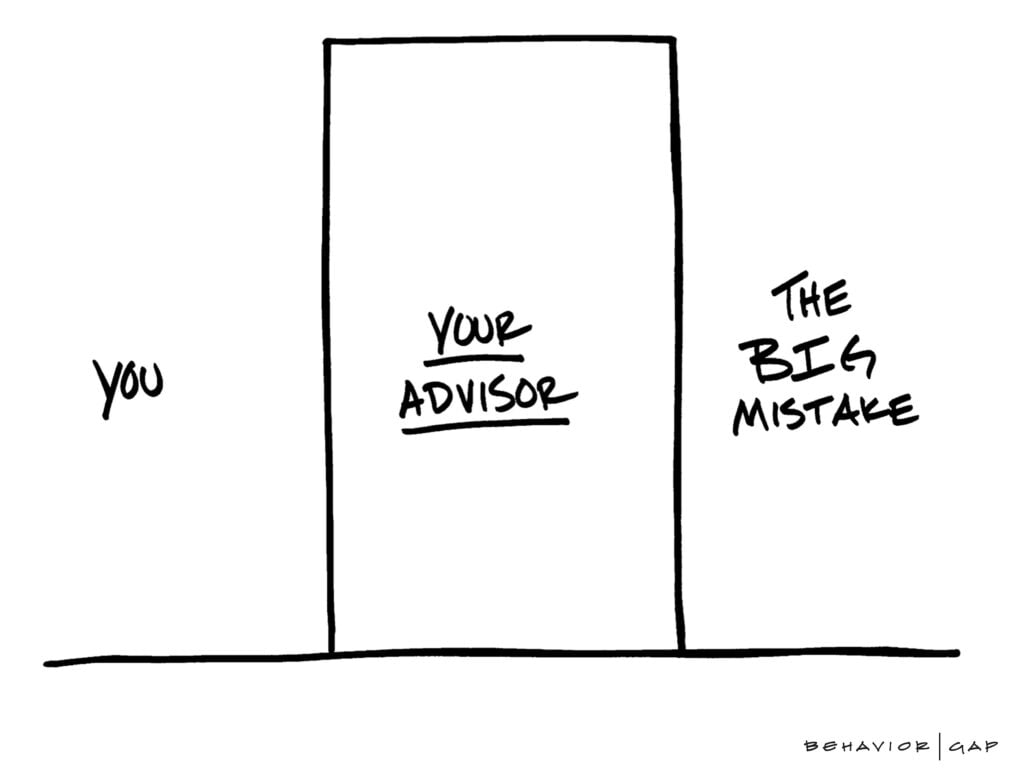

However, the industry in Singapore still revolves heavily around selling commission-based products which do not have your best interests at heart (but do earn salespeople the most money). Although things are slowly improving, many expat and local advisers still follow this model.

These 10 questions are a great starting point to help you select an adviser who’s aligned to your goals, or to sense check whether the adviser you currently work with has your best interests at heart:

- Are you regulated by the Monetary Authority of Singapore? Very simple, only engage with MAS regulated advisers.

- Do you use commission-based products? Always aim to work with a ‘fee-only’ adviser who makes his/her money by adding a flat % fee for managing your wealth.

- Is there any kind of lock-in or penalty? Look for products with no barriers between you and your money. Penalties or lock-ins often indicate a commission-based product is being sold.

- Do you accept trail payments from the funds in your portfolio? If an adviser receives extra income based on selecting certain funds over others, this can add unnecessary cost and creates an element of bias.

- Do you have qualifications above the minimum you’re required to take? Singapore has a relatively low bar in terms of entry requirements for financial advisers, so look for advisers who have gone above the minimum local requirements, ideally holding internationally recognised Chartered or CFP status.

- Can I have written confirmation of all initial and ongoing fees? Good advice isn’t free, but it should be transparent. Ask for a clear breakdown of any product and portfolio fees as well as any initial and ongoing financial advice fees.

- Are you independently owned? Independent firms usually offer a broader range of solutions, whereas advisers that work within tied advice firms may be more restricted.

- How many clients do you look after? As a rule of thumb, a good adviser can look after around 80 to 100 families before their ability to provide high quality, personalised advice begins to diminish.

- Can you provide some client testimonials? This will help verify the adviser and is even better if it’s a public testimonial on LinkedIn, their company website or Google for example.

- What services will you provide to me? Ideally your adviser will offer to meet twice yearly, provide regular updates and reach out on an ad-hoc basis when urgent matters need attending to. Quality advice is all about planning your future. Do they seem genuinely interested in your goals and aspirations and can they show you examples of financial plans they have built for other clients?

We’re here to help

Independently owned and Singapore based, at Ascenta Wealth we’re committed to ethical, fee-only financial advice that works for you, not the big financial institutions. Our relationship is with you, not your money.

If you’re thinking of changing your adviser this new year and would like an honest, no obligation 30-minute Zoom consultation to see whether we can help please reach out to Dan (dan@ascentawealth.com) or Rory (rory@ascentawealth.com).

ANZA members also receive 25% off their advice fees in year one should they choose to engage our services by 31 March 2023.

For more information please visit our dedicated page for ANZA members here.